Oil prices have jumped on concerns that the situation in Israel and Gaza could disrupt output from the Middle East.

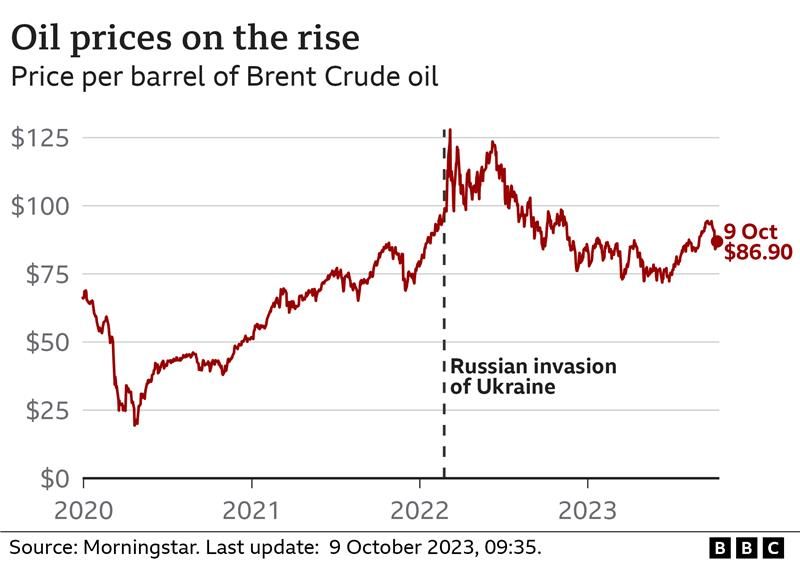

Brent crude, the international benchmark, climbed by $2.25 a barrel to $86.83, while US prices also rose.

Israel and Palestinian territories are not oil producers but the Middle Eastern region accounts for almost a third of global supply.

Hamas’s assault on Israel was the biggest escalation between the two sides for decades.

Western nations condemned the attacks. A spokesperson for Hamas, the Palestinian militant group, told the BBC that the group had direct backing for the move from Iran – one of the world’s largest oil producers.

Iran denied involvement in the assault at a UN Security Council meeting in New York on Sunday, Reuters reported. But Iranian President Ebrahim Raisi has expressed support for the attack.

On Monday, Israel ordered US oil giant Chevron to pause production at the Tamar natural gas field off the country’s northern coast.

The country’s energy ministry, which has closed the field during previous periods of unrest, said there was enough fuel from other sources to meet Israel’s energy needs.

Israel’s largest offshore gas field, Leviathan, continues to operate as normal, Chevron said.

Energy analyst Saul Kavonic told the BBC that global oil prices have risen “due to the prospect of a wider conflagration that could spread to nearby major oil-producing nations such as Iran and Saudi Arabia”.

On Monday morning, the price of West Texas Intermediate crude, the US benchmark, was up $2.50 a barrel at $85.30.

“If the conflict envelops Iran, which has been accused of supporting the Hamas attacks, up to 3% of global oil supply is at risk,” Mr Kavonic added.

Caroline Bain, chief commodities economist at Capital Economics, told the BBC’s Today programme that Iran had been increasing oil production over the course of this year despite US sanctions.

“The US seems to have turned a blind eye to a steady increase in Iranian production, that… is going to be more difficult for the US to ignore going forward from here,” she said.

Overall, Ms Bain said Capital Economics expected demand for oil to exceed supply in the final three months of the year and “that should support higher prices”.

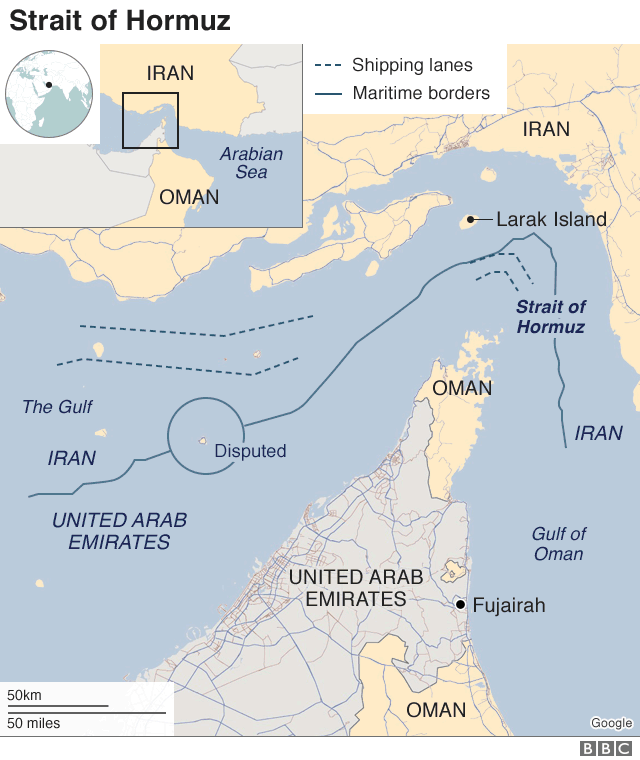

Mr Kavonic said that about a fifth of global supply would be “held hostage” if passage through the Strait of Hormuz, a vital oil trading route is disrupted.

The Strait of Hormuz is crucial for the main oil exporters in the Gulf region, whose economies are built around oil and gas production.

Uncertainty over how events could develop in the coming days may also drive investments into US Treasury bonds and the dollar, which investors traditionally buy at times of crisis, said James Cheo from HSBC bank.

On Monday, Israel’s central bank said it would sell up to $30bn of foreign currency in a bid to calm markets and support the country’s own currency, the shekel, which has fallen sharply.

“At this stage, there is a bit of nervousness. [Investors] want to see a little more clarity, particularly on economic data and on developments associated with geopolitical uncertainty,” added Mr Cheo.

Following Russia’s invasion of Ukraine in February 2022, oil prices soared, hitting more than $120 a barrel in June last year.

They fell back to a little above $70 a barrel in May this year, but have steadily risen since then as producers have tried to restrict output to support the market.

Saudi Arabia, a major oil producer, said it would make cuts of a million barrels per day in July.

Other members of Opec+, a group of oil-producing countries, also agreed to continued cuts in production in an attempt to shore up flagging prices.

Opec+ accounts for around 40% of the world’s crude oil and its decisions can have a major impact on oil prices.